Unveiling the solar panels California tax credit, a remarkable opportunity to harness the sun’s energy while reaping financial rewards. Dive into this comprehensive guide to discover the eligibility requirements, types of tax credits, and strategies for maximizing your savings.

California’s commitment to sustainability shines through its generous tax incentives for solar panel installations. These credits offer homeowners and businesses a substantial reduction in their tax liability, making the transition to solar energy more accessible and affordable.

Solar Panel Tax Credits in California

California offers several tax credits to incentivize the installation of solar panels, making it an attractive investment for homeowners and businesses. These tax credits can significantly reduce the upfront cost of solar panel installation and make solar energy more affordable.

To be eligible for these tax credits, the solar panel system must be installed on a property located in California and must meet certain requirements, such as being interconnected to the electric grid and meeting specific performance standards. The application process for these tax credits typically involves submitting a tax form with supporting documentation, such as a copy of the solar panel installation contract and proof of payment.

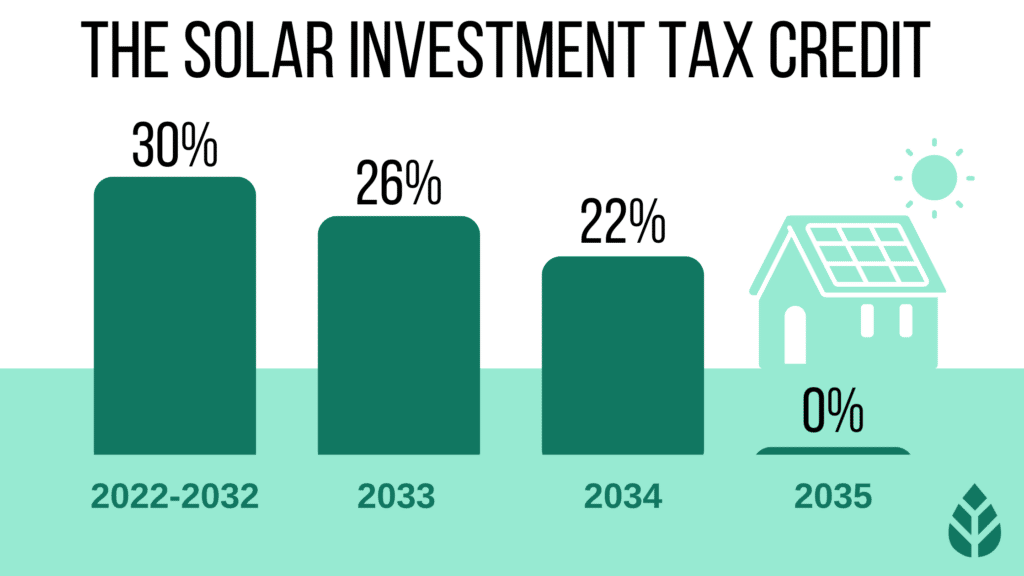

Utilizing solar panel tax credits can provide substantial financial benefits. The federal solar tax credit, known as the Investment Tax Credit (ITC), allows homeowners and businesses to deduct 30% of the cost of their solar panel installation from their federal income taxes. Additionally, California offers a state solar tax credit, known as the California Solar Initiative (CSI), which provides rebates and incentives for solar panel installations. These tax credits can significantly reduce the upfront cost of solar panels, making them a more affordable and attractive investment.

Types of Solar Panel Tax Credits in California: Solar Panels California Tax Credit

California offers various solar panel tax credits to encourage the adoption of renewable energy. These incentives include federal, state, and local tax credits, each with its own benefits and drawbacks.

Federal Tax Credits

The federal government offers a 30% tax credit for residential and commercial solar installations. This credit is available through the Solar Investment Tax Credit (ITC) and can significantly reduce the upfront cost of solar panels.

Benefits:

– Applicable to both residential and commercial installations

– Reduces the cost of solar panels by 30%

Drawbacks:

– Phased down over time, expiring in 2024 for residential and 2023 for commercial installations

– Requires sufficient tax liability to utilize the full credit

State Tax Credits

California offers a variety of state tax credits for solar panel installations, including the following:

– California Solar Initiative (CSI): Provides rebates for residential and commercial solar installations based on system size and location.

– California Self-Generation Incentive Program (SGIP): Offers rebates for residential and commercial solar installations paired with battery storage.

– Property Assessed Clean Energy (PACE) financing: Allows property owners to finance solar installations through their property tax bills.

Benefits:

– Rebates can significantly reduce the cost of solar panels

– PACE financing provides an alternative financing option for property owners

Drawbacks:

– CSI and SGIP rebates are limited and may not be available in all areas

– PACE financing can have higher interest rates than traditional loans

Local Tax Credits

Some local governments in California offer additional tax credits for solar panel installations. These credits vary depending on the municipality and can provide further financial incentives for solar adoption.

Benefits:

– Additional financial incentives for solar installations

– Supports local clean energy initiatives

Drawbacks:

– Availability and amount of credits vary by location

– May require specific installation criteria to qualify

Determining Applicable Tax Credits

The most applicable tax credits for a specific solar panel installation project depend on several factors, including:

– Location of the installation

– Size and type of solar panel system

– Availability of rebates and incentives

– Tax liability

It’s important to research and consult with a qualified solar installer to determine which tax credits are most beneficial for a specific project.

Calculating Solar Panel Tax Credits in California

Calculating the amount of solar panel tax credits that a homeowner or business may be eligible for in California involves several steps. These include determining the cost of the solar panel installation, understanding the available tax credits, and calculating the amount of the credit based on the applicable tax rate.

Determining the Cost of the Solar Panel Installation

The first step is to determine the total cost of the solar panel installation. This includes the cost of the solar panels themselves, as well as the cost of any labor or materials needed for the installation.

The California solar panel tax credit is a great way to save money on your solar installation. However, if you’re experiencing low amperage from your solar panels, it could be a sign of a problem. Low amperage can be caused by a number of factors, including shading, wiring issues, or a faulty solar panel.

If you’re not sure what’s causing the low amperage, it’s important to have your system inspected by a qualified solar installer. Once the problem is identified, you can take steps to fix it and get your solar panels operating at peak efficiency.

This will help you maximize your savings on your solar installation and enjoy the benefits of clean, renewable energy.

Understanding the Available Tax Credits

There are two main types of solar panel tax credits available in California: the federal solar investment tax credit (ITC) and the California solar rebate. The ITC is a 30% tax credit on the cost of the solar panel installation, while the California solar rebate is a rebate of up to $1,000 per kilowatt of solar panels installed.

Calculating the Amount of the Credit, Solar panels california tax credit

The amount of the solar panel tax credit is calculated based on the cost of the installation and the applicable tax rate. For the ITC, the tax credit is equal to 30% of the cost of the installation. For the California solar rebate, the rebate is equal to $1,000 per kilowatt of solar panels installed.

Potential Limitations or Restrictions

There are some potential limitations or restrictions on the amount of solar panel tax credits that can be claimed. For example, the ITC is only available for residential and commercial properties, and the California solar rebate is only available for residential properties.

Maximizing Solar Panel Tax Credits in California

To maximize the solar panel tax credits available in California, homeowners should plan and time their solar panel installation project strategically. This includes researching and understanding the different types of tax credits available, as well as consulting with qualified solar installers who can guide them through the application process.

Strategies for Maximizing Tax Credits

- Plan ahead: Research and understand the different solar panel tax credits available in California, including the federal Investment Tax Credit (ITC) and the California Solar Initiative (CSI) rebates. Determine which tax credits apply to your situation and plan your project accordingly.

- Time your installation: The ITC is scheduled to phase down in the coming years, so it’s important to install your solar panels before the credit expires. The CSI rebates are also subject to change, so check with the California Energy Commission for the latest information.

- Choose a qualified solar installer: Work with a reputable solar installer who is familiar with the tax credit application process. They can help you determine which tax credits you qualify for and assist you with the paperwork.

Importance of Timing

The timing of your solar panel installation project can have a significant impact on the amount of tax credits you can claim. The ITC is scheduled to phase down from 30% to 26% in 2023 and 22% in 2024 before expiring completely in 2025. The CSI rebates are also subject to change, so it’s important to check with the California Energy Commission for the latest information.

Conclusive Thoughts

In conclusion, the solar panels California tax credit is an exceptional initiative that empowers individuals and businesses to embrace renewable energy while enjoying significant financial benefits. By understanding the eligibility criteria, types of tax credits, and optimization strategies, you can harness the sun’s power and minimize your tax burden. Embrace the future of energy efficiency and make the switch to solar today.

FAQ Compilation

Who is eligible for the solar panels California tax credit?

Homeowners and businesses that install solar panel systems in California are eligible for the tax credit.

What are the different types of solar panel tax credits in California?

California offers federal, state, and local tax credits for solar panel installations.

How do I calculate the amount of solar panel tax credit I can claim?

The amount of tax credit you can claim depends on the cost of your solar panel installation and other factors. You can use the California Solar Initiative website to calculate your potential tax credit.

What are some strategies for maximizing my solar panel tax credit?

Some strategies for maximizing your solar panel tax credit include planning your installation project to take advantage of available tax credits and finding qualified solar installers who can assist with the tax credit application process.