Solar panels california government incentives are a key driver in the adoption of solar energy in the state, offering a range of financial and environmental benefits. This comprehensive guide explores the different types of incentives available, their eligibility requirements, and the application process, empowering homeowners and businesses to make informed decisions about investing in solar panels.

Solar Panel Incentives in California

The California solar panel incentives program is designed to encourage the adoption of solar energy in the state. The program offers a variety of incentives, including tax credits, rebates, and performance-based incentives, to make solar energy more affordable and accessible to California residents.

The California solar panel incentives program was established in 2006 with the passage of the California Solar Initiative (CSI). The CSI is a $3.3 billion program that provides rebates and other incentives to homeowners and businesses that install solar energy systems. The CSI has been successful in driving the adoption of solar energy in California, and the state now has more installed solar capacity than any other state in the country.

Types of Solar Panel Incentives in California

Introductory Paragraph

There are three main types of solar panel incentives available in California: tax credits, rebates, and performance-based incentives.

Tax Credits

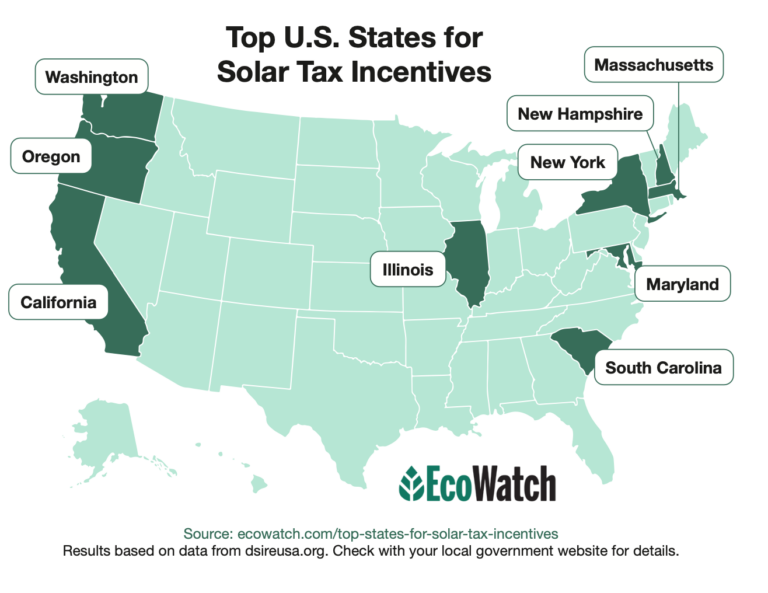

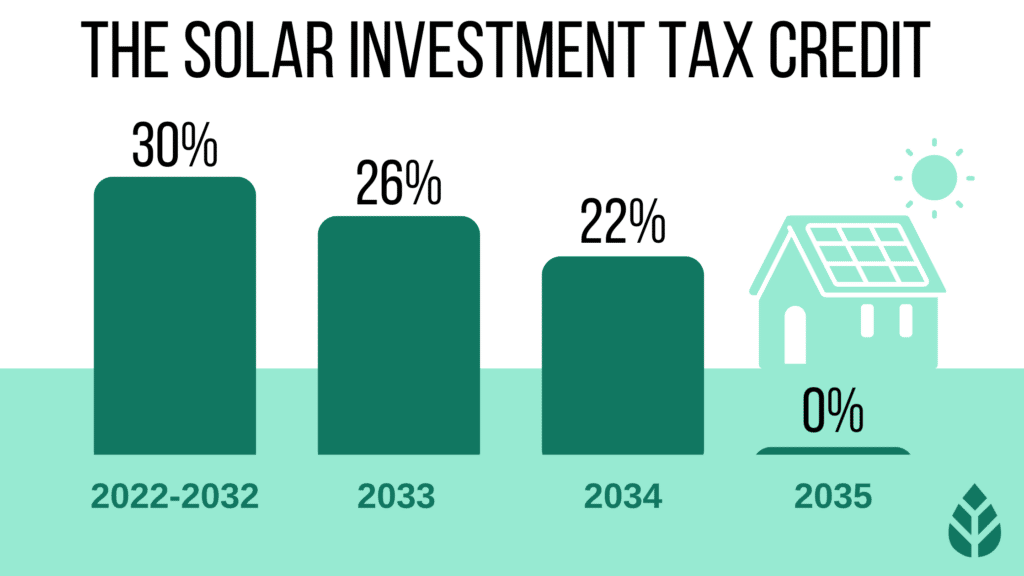

- The federal solar tax credit (ITC) is a 30% tax credit for the cost of installing a solar energy system. The ITC is available to both residential and commercial customers.

- The California solar tax credit (STC) is a 26% tax credit for the cost of installing a solar energy system. The STC is available to both residential and commercial customers.

Rebates

- The California Solar Initiative (CSI) offers rebates for the installation of solar energy systems. The CSI rebates are available to both residential and commercial customers.

- Some local governments in California also offer rebates for the installation of solar energy systems.

Performance-Based Incentives

- Performance-based incentives (PBIs) are payments made to solar energy system owners based on the amount of electricity their systems generate. PBIs are available to both residential and commercial customers.

Eligibility Requirements and Application Process

Introductory Paragraph

The eligibility requirements and application process for solar panel incentives in California vary depending on the type of incentive.

Tax Credits

- To be eligible for the federal solar tax credit, you must own and occupy the home where the solar energy system is installed. You must also meet certain income requirements.

- To be eligible for the California solar tax credit, you must own the home where the solar energy system is installed. You must also meet certain income requirements.

Rebates

- To be eligible for the California Solar Initiative rebates, you must own the home or business where the solar energy system is installed. You must also meet certain income requirements.

- To be eligible for local government rebates, you must own the home or business where the solar energy system is installed. You may also need to meet certain income requirements.

Performance-Based Incentives

- To be eligible for performance-based incentives, you must own the solar energy system. You may also need to meet certain performance requirements.

Application Process

The application process for solar panel incentives in California varies depending on the type of incentive. For more information on the application process, please visit the following websites:

Benefits of Solar Panels in California

Solar panels offer numerous advantages for residents of California, contributing to both environmental and financial well-being while supporting the state’s sustainability goals.

Environmental Benefits

By harnessing the sun’s energy, solar panels significantly reduce greenhouse gas emissions. California, a leader in combating climate change, has set ambitious targets for reducing its carbon footprint. Solar panels play a crucial role in achieving these goals, promoting renewable energy sources and mitigating the effects of climate change.

Financial Benefits

Solar panels provide substantial financial benefits for homeowners and businesses alike. They drastically reduce energy costs, leading to significant savings on electricity bills. Additionally, solar panels can increase property value, making them a worthwhile investment for homeowners.

Contribution to California’s Energy Goals

California has set ambitious renewable energy targets, aiming to generate 100% of its electricity from clean sources by 2045. Solar panels contribute significantly to achieving this goal, increasing the state’s energy independence and reducing its reliance on fossil fuels. By embracing solar energy, California can enhance its sustainability and secure a cleaner future for its residents.

Government Programs and Initiatives

The California government actively supports the adoption of solar energy through various programs and initiatives. These initiatives provide financial incentives, streamline permitting processes, and offer technical assistance to encourage homeowners and businesses to install solar panels.

Government agencies, such as the California Energy Commission (CEC) and the California Public Utilities Commission (CPUC), play a crucial role in promoting solar energy adoption. They set renewable energy targets, establish incentive programs, and regulate the solar industry to ensure consumer protection and grid reliability.

Government Programs and Initiatives Summary

| Program Name | Funding Source | Eligibility Criteria | Application Process |

|---|---|---|---|

| California Solar Initiative (CSI) | CPUC | Residential, commercial, and non-profit organizations | Apply through a participating contractor |

| Solar Energy Rebate Program (SERP) | CEC | Residential customers of participating utilities | Apply online or through a participating contractor |

| Property Assessed Clean Energy (PACE) Financing | Local governments | Residential and commercial property owners | Contact local government or a PACE provider |

| Net Energy Metering (NEM) | CPUC | Residential and small commercial customers | Contact local utility |

Impact on California’s Energy Grid

Solar panels play a significant role in stabilizing and enhancing the reliability of California’s energy grid. By generating clean, renewable energy, solar panels reduce the state’s reliance on fossil fuels and imported electricity.

As of 2023, solar panels account for approximately 12% of California’s total electricity generation. This percentage is expected to increase in the coming years as the state continues to invest in solar energy.

In California, solar panel incentives from the government can significantly reduce the cost of installing solar panels. However, even with proper installation, issues can arise. If you find that your solar panel is not working after a repair, refer to Solar panel not working after repair for troubleshooting tips.

Government incentives for solar panels in California can still provide financial assistance despite potential repairs.

Challenges and Opportunities

Integrating solar energy into the grid presents both challenges and opportunities. One challenge is the intermittent nature of solar power, as it is only available during daylight hours. To address this, California has invested in energy storage systems, such as batteries, to store excess solar energy and release it when needed.

Another challenge is the need to upgrade the grid infrastructure to accommodate the increased flow of solar energy. However, this also presents an opportunity to modernize the grid and make it more resilient and efficient.

Future Trends and Outlook: Solar Panels California Government Incentives

The solar energy industry in California is poised for continued growth in the coming years, driven by advancements in technology, supportive government policies, and increasing consumer demand for clean energy.

One of the key trends shaping the future of solar energy in California is the development of new technologies, such as energy storage systems, which allow homeowners and businesses to store excess solar energy generated during the day and use it at night or during periods of peak demand.

Energy Storage Systems, Solar panels california government incentives

Energy storage systems are becoming increasingly affordable and efficient, making them a more viable option for homeowners and businesses looking to maximize their use of solar energy. By storing excess solar energy, these systems can help reduce reliance on the grid and lower energy costs.

Another emerging trend in the solar energy industry is the development of new solar panel technologies, such as perovskite solar cells, which have the potential to be more efficient and less expensive than traditional silicon-based solar panels.

Perovskite Solar Cells

Perovskite solar cells are still in the early stages of development, but they have the potential to revolutionize the solar energy industry by making solar panels more affordable and accessible to a wider range of consumers.

The future of solar energy in California looks bright, with continued advancements in technology, supportive government policies, and increasing consumer demand driving the growth of the industry. Solar energy is expected to play an increasingly important role in meeting the state’s energy needs and reducing its carbon footprint.

Final Review

As California continues to lead the nation in solar energy adoption, government incentives play a crucial role in making solar panels more accessible and affordable. By understanding the various programs and initiatives available, individuals and organizations can harness the power of solar energy to reduce their energy costs, contribute to a cleaner environment, and support the state’s sustainability goals.

FAQ

What are the different types of solar panel incentives available in California?

California offers a range of solar panel incentives, including tax credits, rebates, and performance-based incentives. Tax credits reduce the amount of taxes owed, while rebates provide a direct payment to homeowners and businesses. Performance-based incentives reward solar energy production.

How do I apply for solar panel incentives in California?

The application process for solar panel incentives varies depending on the type of incentive. Tax credits are claimed on state income tax returns, while rebates and performance-based incentives typically require a separate application to the relevant government agency.

What are the eligibility requirements for solar panel incentives in California?

Eligibility requirements for solar panel incentives vary depending on the program. Generally, homeowners and businesses must install solar panels on their property and meet certain system size and performance criteria.